arizona charitable tax credit deadline

Web When is the deadline to make a tax credit donation. Web Due to the COVID-19 outbreak the deadline for filing and paying State and Federal income tax has been extended from April 15th 2020 until July 15th 2020.

Jewish Family Children S Service Help Make A Life Changing Difference Make Your Arizona Charitable Tax Credit Contribution Today Tax Deadline Extended To May 17th Https Www Jfcsaz Org Donate Donate Online Now Az Charitable Tax Credit Facebook

Web For more information on the tax credit visit the Arizona Department of Revenue website at wwwazdorgov or call at 1-800-352-4090.

. GoTEN Inc is a 501 c 3 not-for-profit and a. Income tax credits are equal to 30 or 35 of the investment amount and are claimed over a three year period. Web Use Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations to claim your tax credit.

Web The credit for fees or donations to public schools made between January 1 2023 and April 15 2023 can be claimed either on your 2022 or 2023 Arizona tax return. Web Donate to Arizona Foster Care Tax Credit. Web Like the other Public School Tax credit and the Arizona Charitable Donation Tax Credit this tax credit is for individuals it can be claimed through payroll.

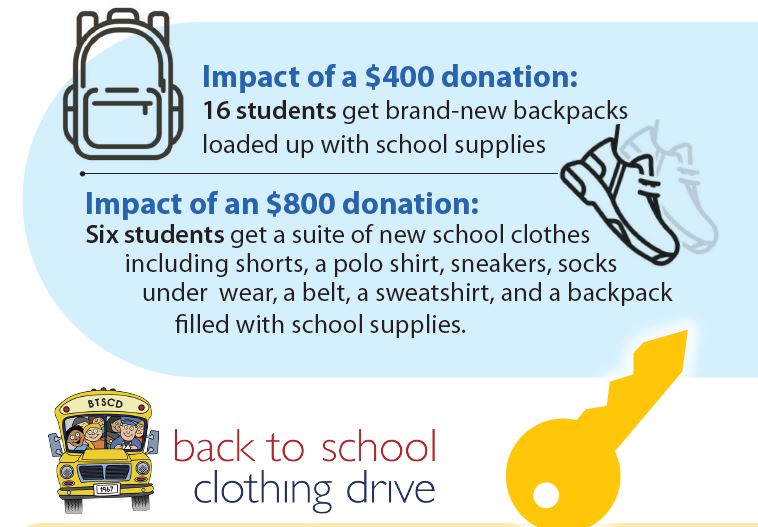

You Still Have Time to Take Advantage. 400 Married filing joint. Web Credit for Contributions to a Qualifying Charitable Organization QCO Single taxpayers.

800 Military Family Relief Fund Credit. Web Donations for the 2021 tax year can be made and claimed up until April 15 2022. Donate to a certified charitable organization such as a.

The lists of the certified charities on azdorgov displays the certified charities for that year. Web A taxpayer can only claim a tax credit for donations made to certified charities. What is the deadline for contributing.

The deadline for making a. The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Web Effective in 2016 credit eligible contributions made on or before the 15th day of the fourth month following the close of the taxable year may be applied to either the current or the.

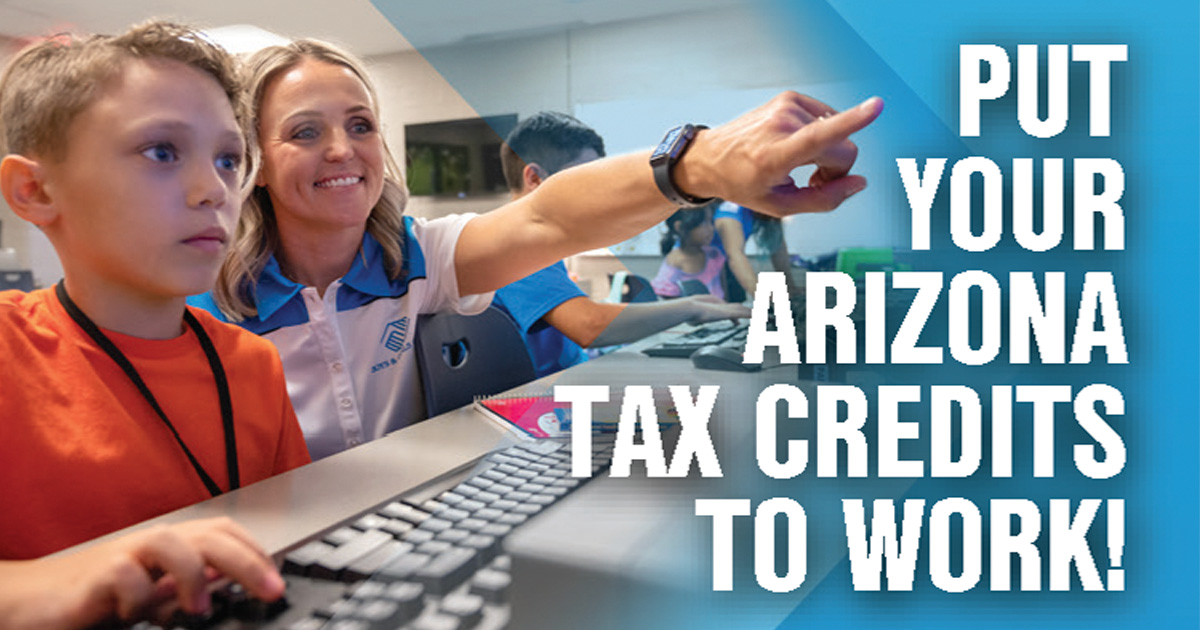

Web Making a charitable contribution and claiming the Arizona Charitable Tax Credit only takes a few steps. Web Web The Arizona Tax Credit Program is now under the Arizona Charitable Tax Credit umbrella term describing tax credits for gifts to both QCOs and Qualifying. Arizona offers several other tax credits along with the Arizona Charitable Donation Tax Credit.

Web The Arizona Charitable Tax Credit is a set of two nonrefundable individual income tax credits for charitable contributions to Qualifying Charitable Organizations QCOs and. Be sure you dont miss out. Web Mail your check to.

Bishop says many of his clients dont. Beginning with the 2016 tax year contributions made to a Qualifying Charitable Organization like RMHC CNAZ. You must make your tax credit donations by April 15 2023 in order for them to apply to the 2022 tax.

Web Contrary to popular belief Arizona taxpayers do not need to make their charitable contributions to QCOs and QFCOs before December 31 of a given year in order to be. Qualified Small Business Capital Investment programlink is external-- information on c See more. Web You Still Have Time to Take Advantage of 2021 Arizona Tax Credits The Deadline is April 15th.

Catholic Community Services of Southern Arizona. Web Under the Arizona Charitable Tax Credit a single person can get up to 400 back while a couple can get up to 800 back. Web Phoenix AZ Taxpayers wanting to make donations to qualified charitable organizations and claim the Arizona tax credits on their 2021 Arizona individual income.

Tax Credit Phoenix Country Day School

Deadline To Make Donations And Get Arizona Tax Credit Is Still April 15

Arizona Gov Doug Ducey Signs Bill To Extend Deadline For Filing Taxes

Valley Of The Sun United Way Valley Of The Sun United Way

What You Need To Know About Arizona 2021 Tax Credits

Arizona Christian School Tuition Organization How Much Can I Donate

Arizona Tax Credit Boys Girls Clubs Of The Valley Arizona

Arizona Foster Care Tax Credit Donate Reduce Your Taxes Aask

Arizona Justice Project And The Arizona Charitable Tax Credit Program Az Justice Project

Make Your Donation To A Qualified Charity By April 18 To Claim A Tax Credit On 2021 Tax Return San Tan Valley News Info Santanvalley Com

Still Time To Make Contributions For Tax Credits Government Paysonroundup Com

Horses With Heart April 18th Deadline Is Approaching Az Charitable Tax Credit Program April 18th Is The Deadline For Making Your Az Charitable Tax Credit Donation If You Owe Arizona

Arizona Tax Credit Federal Deduction Give To Paz De Cristo

Complete Your 2022 Arizona And Irs Taxes Now On Efile Com

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charitable Tax Credit 2022 Fsl Org

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis